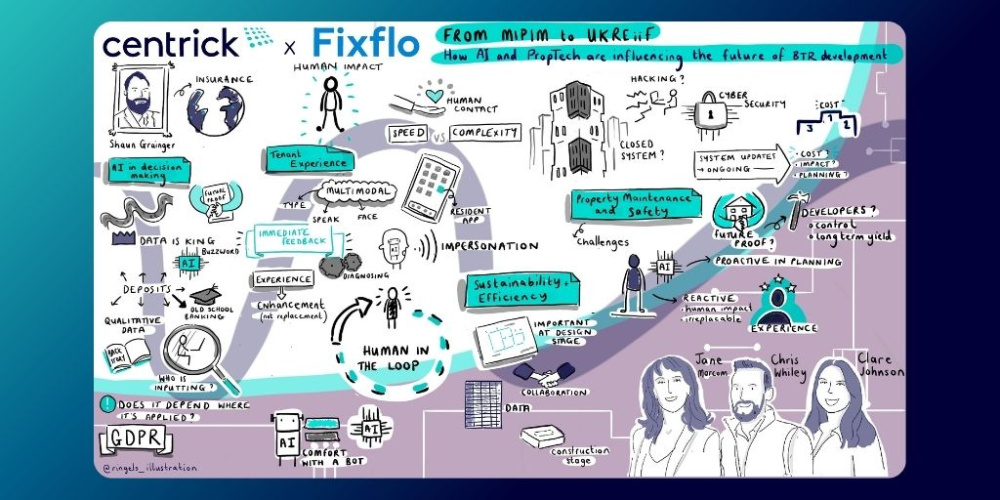

Centrick’s latest roundtable brought together a powerhouse of Build to Rent (BTR) and PropTech professionals to unpack the growing role of Artificial Intelligence (AI) across the property lifecycle. From development risk to tenant experience and ESG compliance, the discussion spanned both the promise and the pitfalls of AI in the BTR sector.

Moderated by Shaun Grainger, Director of Residential at WTW, the session drew insights from Shawbrook Bank, Elevate Living, Anstey Horne, PRP, Dwellant, Iterum, 2N, and Centrick.

Grainger opened with a focus on how AI is already appearing in day-to-day operations such as flood detection, but questioned how well the sector is adapting to more sophisticated uses, particularly around resident engagement and operational efficiencies.

AI is here… but will it replace humans?

Tirath Singh, Senior Relationship Manager at Shawbrook, highlighted that while AI is gaining visibility across the sector, it’s not yet embedded in how major financial decisions are made, particularly where risk and yield are concerned.

“We need to understand that risks are being mitigated,” he said. “There’s still a reliance on quantity surveyors and expert opinion, looking at operator experience, location, yield projections. It’s still quite manual at the moment, and we’re not yet using AI models to make those decisions.”

He added: “Buildings can look great on paper, but you still need someone on the ground to spot issues like leaks – AI can’t replace that just yet.”

Inder Thatal, Associate Director at Anstey Horne, raised a related point around data accuracy:

“One of the key questions is: who’s inputting the data that AI is learning from, and how do we validate it?” he said. “More time is now being spent making sure the data is accurate in the first place, because if that’s wrong, the output from any AI system is ultimately going to be of limited value.”

Operational efficiency, designed from day one

Clare Johnson, Build to Rent Director at Centrick, discussed the need to consider long-term operational costs during early design stages:

“As an operator, we’re always conscious of operational expenditure. We work closely with clients at the early design stage to help future-proof developments, not just from a resident experience perspective, but in terms of infrastructure and the systems going into the building,” she said. “The technology chosen can significantly influence long-term efficiency, insurance risk and operational cost. It’s vital that systems can communicate effectively and that we can extract useful data from them to support efficient management.”

The impact of AI on resident experience

Sarah Nelson, Director at Elevate Living, shared her insights on chatbots:

“People often feel more comfortable asking bots questions they might feel silly asking face-to-face, which is where AI can take pressure off onsite teams,” she said. “There’s also real potential for AI to support team development, coaching resident teams through more difficult situations.”

Jez Hildred, A&E Manager at 2N, echoed the benefits of AI in augmenting rather than replacing human roles:

“Where AI has worked well is in enhancing human roles, not replacing them. In security, for example, AI can do the heavy lifting by monitoring patterns and flagging inconsistencies, but you still need a person to review the alerts.”

He added: “We’re now able to track how people use a building, from how often amenities are accessed, to which areas are underused. That insight can feed into building management and marketing decisions.”

Designing for ESG and longevity

Richard Daw, Director at PRP Architects, emphasised that AI’s influence on sustainability begins at the design stage:

“For architects, ESG and operational efficiency start at the earliest design stage. AI is already helping us to model performance, from heating and cooling systems to material choices and wall-to-wall ratios. It’s a valuable tool in the background,” he said. “But ultimately, we’re designing places for people to live. AI can support that process, but the creative and human element has to lead.”

Craig Johnson, Executive Director at WTW, expanded on the insurance challenge:

“The more complex the risk, the more human input is needed. In insurance, AI can help process large volumes of data quickly, but with BTR the models aren’t always mature enough to capture the nuance. You still need that expert lens,” he said. “We don’t always have the historical data we’d like for modern methods of construction, which makes dynamic pricing models difficult. That’s where good collaboration becomes essential.”

Maintaining your PropTech

Chris Whiley, Group Projects Director at Centrick, reinforced that AI should support, not replace, human input:

“AI should always be seen as an enhancement, not a replacement. That 80/20 rule applies – you still need people involved to check, steer and refine the output,” he said. “The tech is moving incredibly fast – ChatGPT reached 100 million users in just a few months, faster than any platform before it. But that speed brings risk. If you’re trying to build AI solutions from scratch without the right safeguards, you could expose your business to some serious issues.”

Chris continued: “Investing in PropTech isn’t like putting up a building, it’s like growing a garden. It needs ongoing attention, updates, and care. Systems will only stay smart if they’re maintained properly,” he said. “Without enough input, systems can’t model risks or performance accurately, and that can expose gaps we didn’t know were there.”

Conclusion: Smart Tech, Human-Led

The event closed with a clear message: AI is no longer a future conversation, it’s already hugely influencing operations, decision-making and investment across the BTR sector. But successful adoption requires collaboration, data integrity and a realistic understanding of both AI’s potential, and its risk and limits.

As the sector evolves, AI will undoubtedly become part of the toolkit for forward-thinking operators and investors. But it must remain guided by human expertise, strategic planning, and a long-term view of value.

A huge thank you to everyone who joined the roundtable, to our moderator, Shaun Grainger, and to FixFlo for partnering with us.

View questions and attendee biographies

Interested in attending future roundtables or exploring how Centrick can support your portfolio?

Visit centrick.co.uk/events or get in touch with our team to start the conversation.